ESG Data Collection

Why does ESG matter?

There is one thing we all know for sure: climate change is affecting the whole world. And, the responsibility for a future in a sustainable environment lies with each and every one of us.

This is where sustainable finance comes in. The primary goal of sustainable finance is to make the economic system more resilient to climate-related financial risks. Going forward, costs of physical and transition risks will need to be factored in.

EXAMPLE: A company builds a plant near a coastline where floods are becoming more and more likely as the climate heats up. An investor financing this plant will bear some of that climate-related risk, and thus wants to assess the likelihood of this event. Reporting based on accurate data is a cornerstone in monitoring an organization’s financial sustainability.

What exactly is ESG?

Learn why ESG data plays an important role

Why do we need ESG data?

How do we benefit from ESG data?

Solutions as individual as our customers

For us, sustainable financing isn't a standalone product; rather, it offers numerous options, including financing that incorporates ESG-related criteria. In addition to sustainable financing, our digital services such as e-banking, RayPay, and recyclable cards also contribute to our efforts to reduce carbon emissions. We support you in finding the best sustainable solutions for you and your business!

How to complete the RBI ESG Questionnaire

What elements does the RBI ESG Questionnaire have?

General Info

- Main industry

- Reporting year

- Consolidated vs. Stand-alone

Environment Questions

- Production/Value-added

- GHG emissions & SBTi

- Energy consumption

- EU Taxonomy

- Circular economy

- Water consumption

- Sustainable finance instruments

Feedback

- Customer Effort Score

- Qualitative feedback

FAQs

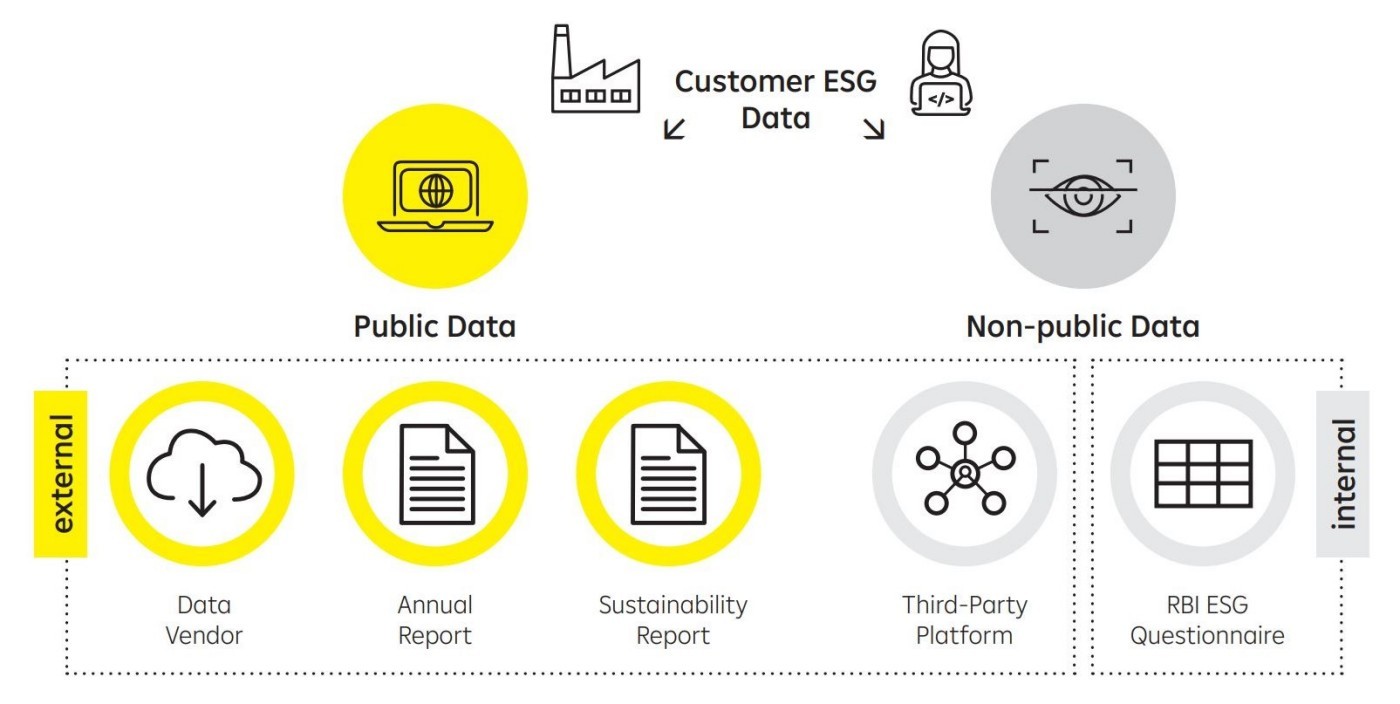

Yes, RBI strives to collect as much ESG data as possible from already published sources – including data related to the sustainability aspects "Social" and "Governance". However, we still need to ask you a few additional questions that relate to the "Environment" aspect.

Yes, RBI gathers all data required for Social and Governance related requirements out of your Sustainability Report and the Annual Report.

We know that it might be challenging to compile all the requested ESG data. This is especially true if your company is not yet obliged to disclose ESG data according to the Non-Financial Reporting Directive of the EU. If you don’t have certain ESG data available, send us the RBI ESG Questionnaire back even with blank fields – please, forward us your available information in any case.

Once a year.

Your relationship manager will be informed as soon as the RBI ESG Score is calculated and can be communicated to you.

Grey fields are either inactive or will be completed by the bank – you don’t need to do anything in these fields.

In the Excel tab "Glossary" you will find useful definitions and weblinks to the respective regulatory frameworks.

In the Excel tab "Industries clustering" you will find a mapping based on GICS (Global Industry Classification System).

Please select whether you are entering consolidated or stand-alone data. Stand-alone data is preferred as it allows for a more accurate reporting. However, if data is only available at consolidated group level - such as GHG (Greenhouse Gases) emission data - then consolidated group data shall be collected. IMPORTANT: Please, only enter either stand-alone or consolidated data, but do not switch the reporting level between the questions!

Do not hesitate to send your questions via email to: RBI-ESG-Support@rbinternational.com